Last modified: May 28, 2024

Canadian dispensaries: Navigating your financial reports for tax purposes

Accessing your financial reports

To assist in your financial record keeping, reports can be viewed and exported from your account. These reports, available after your first successful payout, record payout history and sales activity and can be used to calculate Fullscript net income and other financials transacted through your Fullscript account.

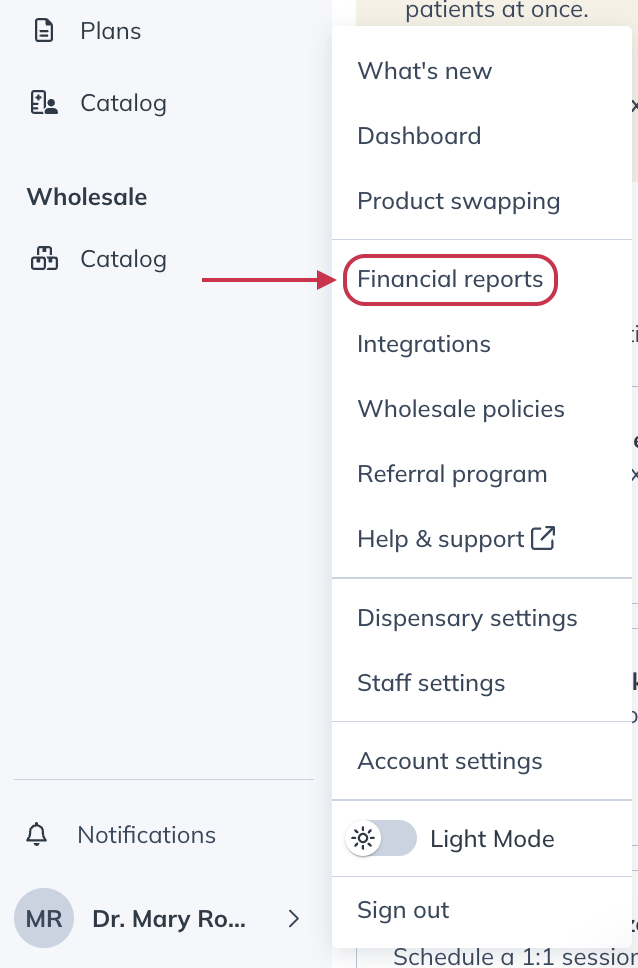

To access these reports, select Financial reports from the practitioner menu.

Account activity and balance report summary

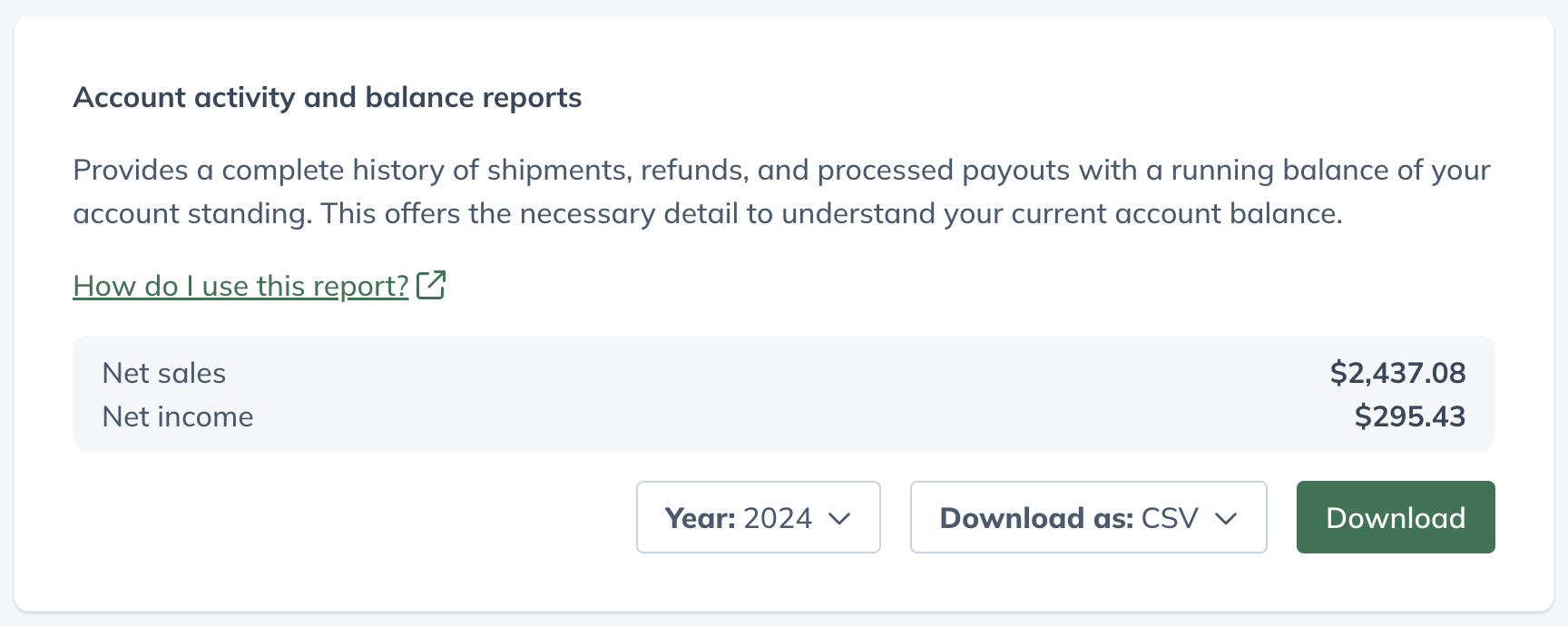

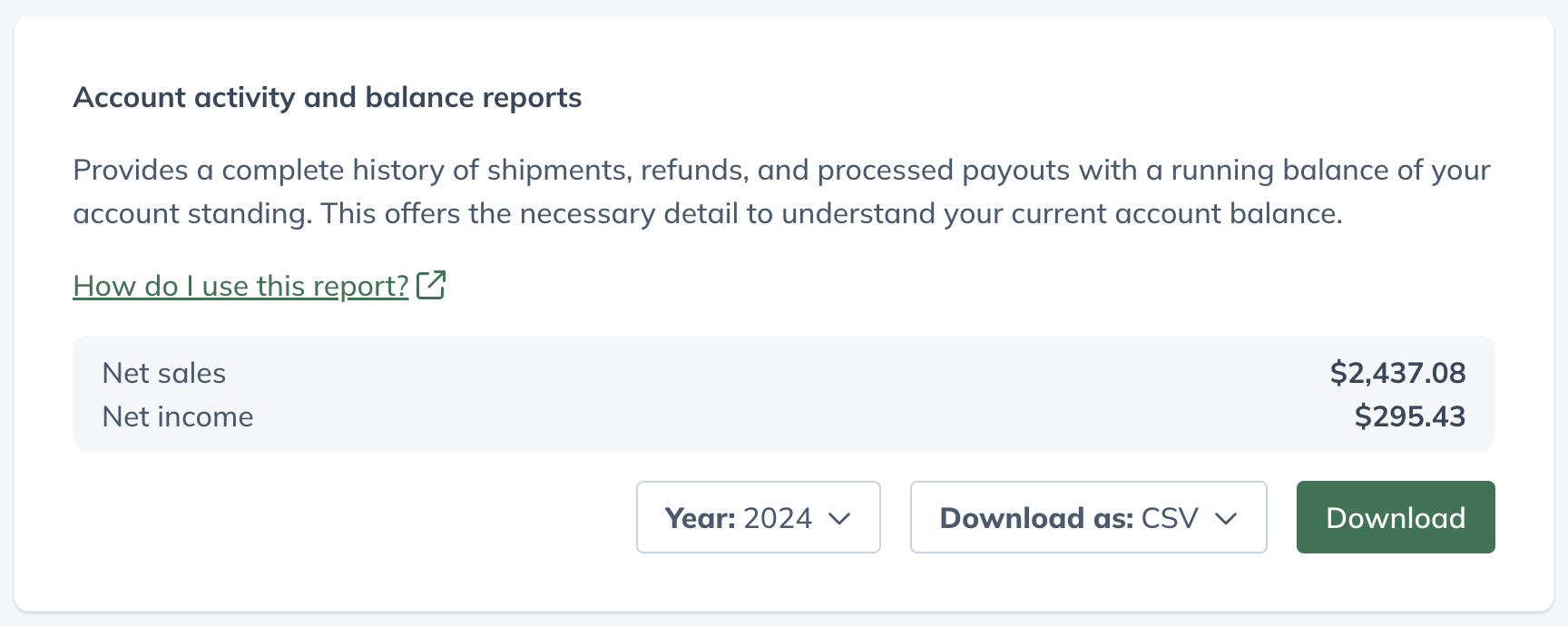

The Account activity and balance report is a running balance of transactions within the selected time period, calculating net sales, cost of sales, and net income from payments transacted through your account.

You can download the Account activity and balance report from the Reports page scrolling to the related section, selecting the desired reporting year and file format, and clicking Download.

Calculating net sales, cost of goods, and net income

Net sales, cost of sales, and net income transacted through your Fullscript account are calculated and displayed in the account activity and balance report summary after selecting a tax year (see the example above).

The steps and example below will walk you through how to export this report and understand how these figures are calculated.

Step 1: Download the account activity and balance report

To download the account activity and balance report:

- Select your name or avatar to open the practitioner menu, then click Financial reports. On mobile devices, select the menu icon ( ), followed by your name or avatar, then tap Financial reports.

- Scroll to the Account Activity and Balance Report heading.

- Select a year.

- Select your preferred file type (Excel or CSV).

- Click Download.

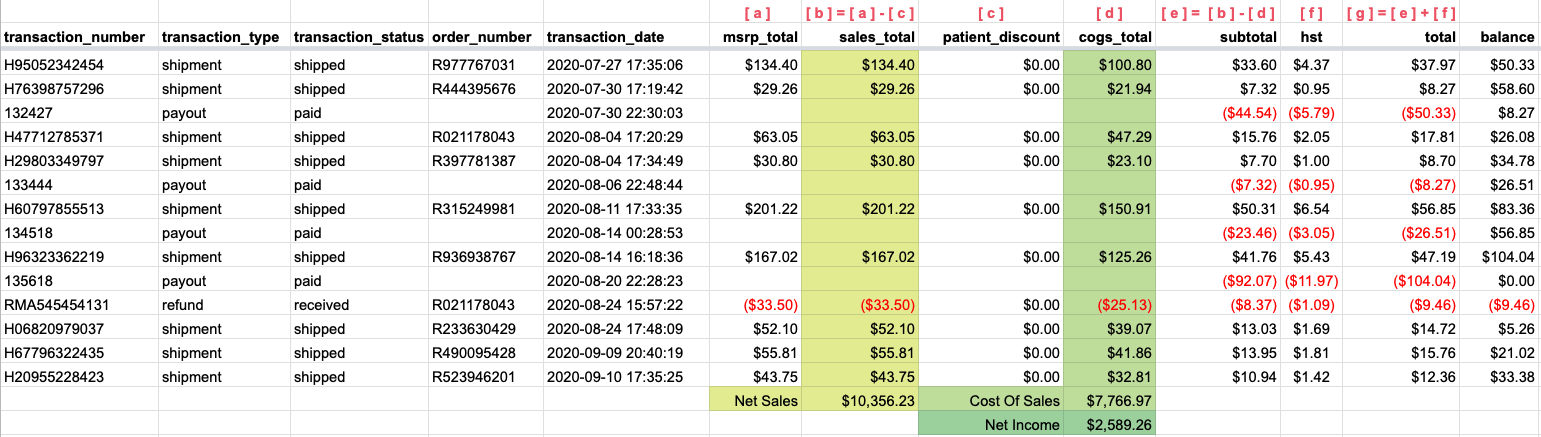

The Excel export will resemble the example below.

| Column title | Description |

|---|---|

| transaction_number | The shipment ID. |

| transaction_type |

The row’s record type. i.e., payout, refund, or shipment. |

| transaction_status | The record’s status. e.g., amounts paid (payouts), shipped (orders), or received (refunds). |

| order_number | Fullscript order number. |

| transaction_date | The date the shipment shipped, the date the refund was received, or the date the payout was paid. |

| msrp_total | Total MSRP (manufacturer suggested retail price) in the shipment. |

| sales_total | Represents the total retail cost and is calculated as the MSRP total less the patient discount. |

| patient_discount | The discount amount deducted from the order total (i.e., patient savings in dollars). |

| cogs_total | Fees representing product cost and Fullscript fees associated with administering the transaction. Referred to as the cost of sales or cost of goods sold (COGS). |

| subtotal | Represents the order’s net earnings to be paid before HST and is calculated as sales_total less cogs_total. |

| hst | HST paid (appended to payout) if the customer provided their business number to collect HST on payouts. |

| total |

Represents net earnings from the transaction and is calculated as sales_total less cogs_total plus hst. |

| balance |

Running balance of funds available for payout. |

Step 2: Calculating Fullscript net sales

Net sales represent the total retail value of orders transacted through the Fullscript account. For this, we sum up the values in the sales_total column. In the example below, we see a total of $10,356.23.

Step 3: Calculating Fullscript cost of sales

Cost of Sales represents the costs incurred to transact the sale through Fullscript. For this, we sum up the values in the cogs_total column. In this example, we see a total of $7,766.97.

Sales tax

Fullscript maintains 100% responsibility for the collection and remittance of retail tax in all provinces of Canada (HST/GST/PST/QST).

Additionally, when provided a GST/HST registration number, Fullscript pays passthrough tax to practitioners as the CRA deems the transfer of profit margin to be a separate and taxable event. If you are registered to collect GST/HST, go to the Dispensary info page to provide your registration number and ensure appropriate taxes are included in your payouts.

T4A forms

2020 tax year and later

A T4A will be issued if you receive a minimum of $500 in payouts (before taxes) during the tax year. Your T4A can be downloaded from Reports between late January and early February.

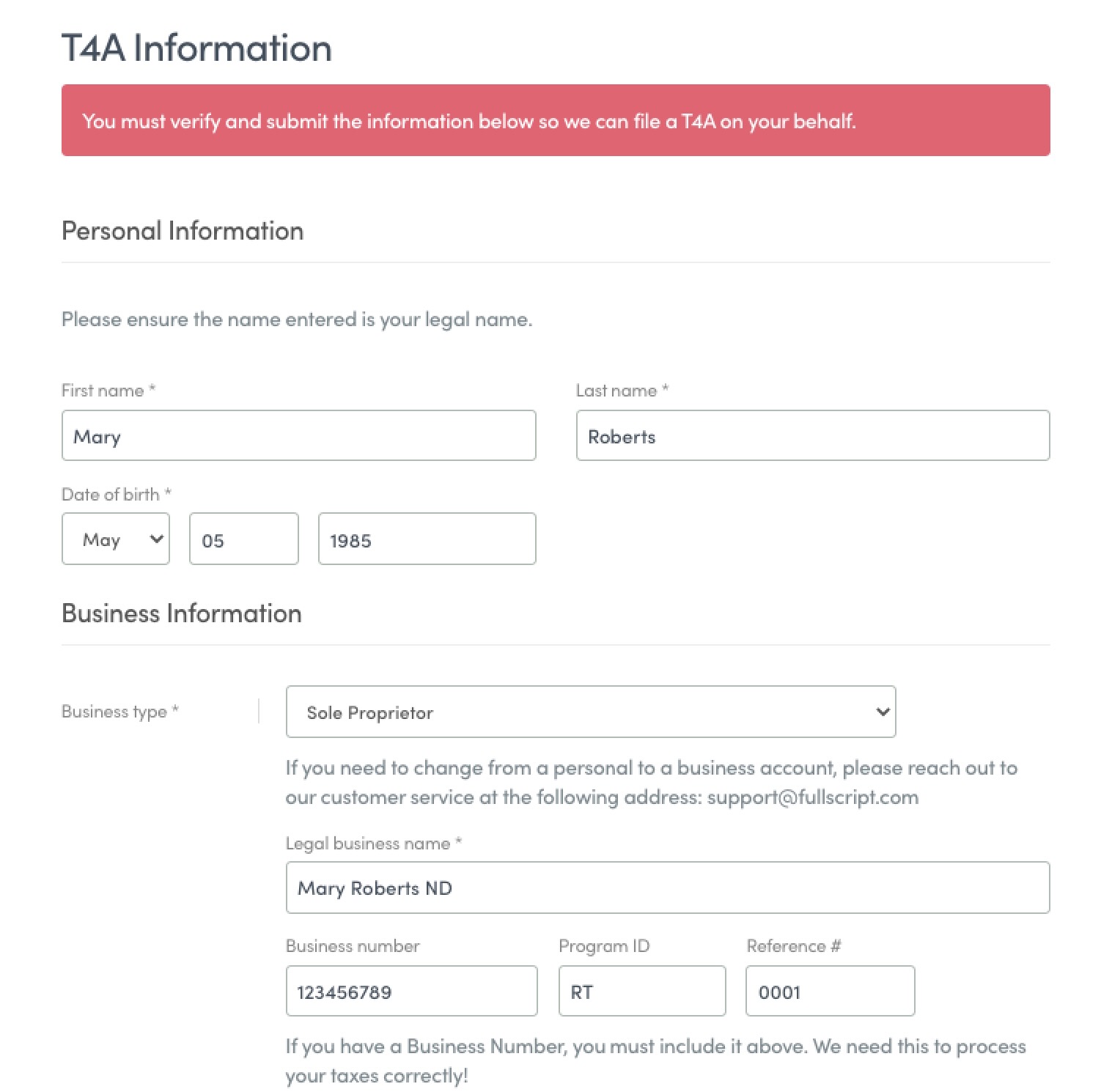

If you’re on track to be eligible for a T4A, a banner will appear at the top of your account. This will prompt you to Verify your information so we can file a T4A on your behalf.

This information must be accurate and up to date, as this is what we’ll use to generate your T4A. If you have a business number, please enter the full number, including the Program ID and Reference #.

Once completed, check the box next to I certify that this information is correct, then Submit.

2019 tax year and earlier

If you received $500 or more in payouts (before taxes), you can request a T4A for your records. Please contact support@fullscript.com to request a PDF copy.

Frequently asked questions

In this section:

What do I need to share with my tax professional to complete my taxes?

Where can I download a copy of my T4A?

Why is the sales tax paid to practitioners on payouts a different rate than the sales tax paid by patients?

How do I remit my HST proceeds to the CRA?

Do I need to provide Fullscript with a GST/HST number?

Why doesn’t the amount on my T4A match the net income amount in the account activity and balance report?

What do I need to share with my tax professional to complete my taxes?

✔ Account activity & balance report (for the appropriate tax year)

✔ The HST amounts paid by Fullscript (if GST/HST is collected)

✔ T4A (if eligible)

Where can I download a copy of my T4A?

We’ll issue a T4A if you receive a minimum of $500 in payouts (before taxes) during the tax year. Download your T4A from your Financial reports page once they’re available. T4As should be ready in late January to early February following the end of the tax year.

Why is the sales tax paid to practitioners on payouts a different rate than the sales tax paid by patients?

One of the main factors in determining sales tax is the address of the purchaser (more specifically: ship to address). In short, the payout made to the practitioner is a separate transaction between Fullscript and the practitioner that also requires sales tax to be added. However, since this is a transaction from the practitioner to Fullscript, the destination billing address is our Ontario address.

How do I remit my HST proceeds to the CRA?

HST amounts paid by Fullscript to your dispensary can be calculated from the Account activity & balance report by downloading the report for the appropriate tax year, filtering for HST transaction types, and adding them together. HST is also displayed under the ‘Summary’ heading in individual Payout reports if you have provided Fullscript with your GST/HST registration number.

Do I need to provide Fullscript with a GST/HST number?

This is not a requirement to use Fullscript; however, it is the responsibility of the practitioner account holder to ensure they meet the thresholds and requirements needed to register for GST/HST should they choose to.

Why doesn’t the amount on my T4A match the net income amount in the account activity and balance report?

The T4A amount is the total amount received in payouts during the year (excluding tax), whereas the net income calculated in the account activity and balance report reflects total earnings during the year, including those that haven’t yet been paid.